Identifying Wells Fargo’s most profitable investment portfolios requires analyzing various factors, including consistent revenue generation, high profit margins, and relatively low operational costs. Specific portfolio performance data is proprietary and not publicly released in sufficient detail to definitively declare one as the singular “cash cow.” However, areas like wealth management, which includes high-net-worth client services and investment advisory, are frequently cited as significant contributors to Wells Fargo’s overall profitability due to their recurring revenue streams and the potential for substantial fees.

High-yield portfolios, though subject to market fluctuations, contribute significantly to earnings when market conditions are favorable. Their sustained profitability over time is crucial to a financial institution’s stability and ability to invest in other initiatives. These highly profitable areas provide a foundation for funding expansion, technological upgrades, and bolstering the firm’s resilience during economic downturns. A consistent stream of income from successful investment strategies allows for sustained growth and shareholder returns.

Further analysis requires examining Wells Fargo’s financial statements, specifically focusing on segment revenue and profit breakdowns to gain a deeper understanding of the relative contributions of different portfolios. This will allow for a more nuanced assessment of the drivers behind the company’s financial performance and reveal those areas exhibiting the most stable and substantial returns.

Images References

Source: www.salon.com

Wells Fargo's prison cash cow

Source: www.educba.com

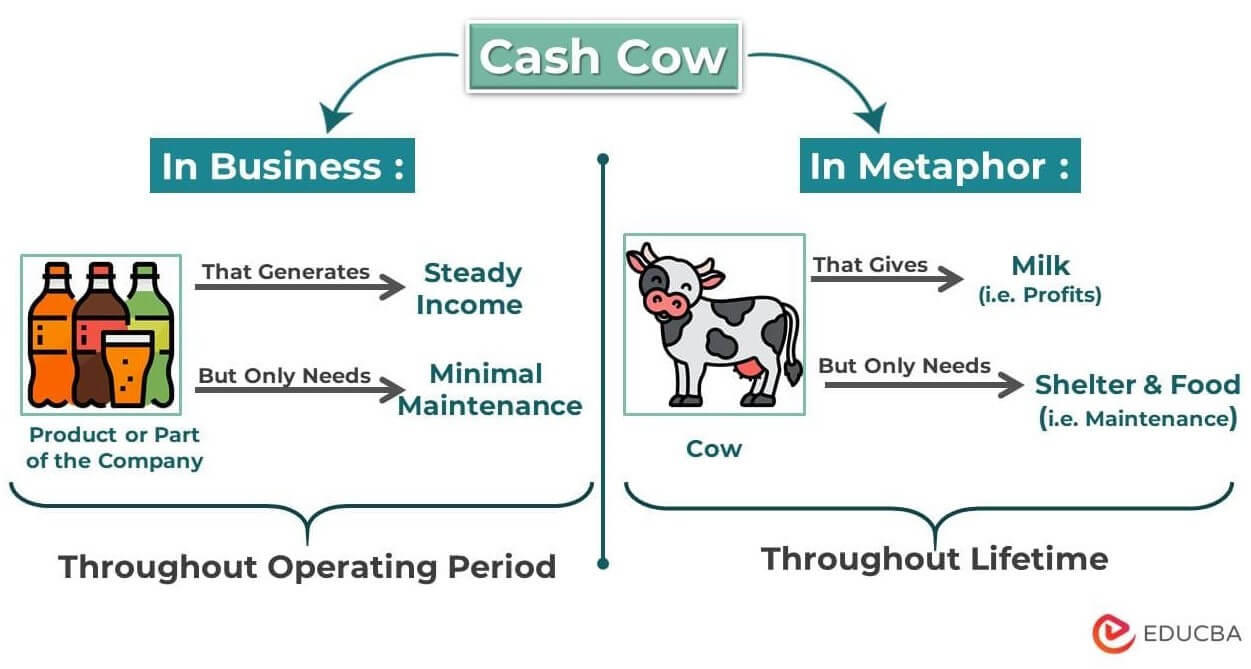

What Does Cash Cow Mean? RealWorld Examples & Case Study

Leave a Reply