The assertion that Dominion Energy’s board of directors lacks the necessary skills or judgment to effectively govern the company represents a critical assessment of corporate leadership. This critique implies failures in strategic decision-making, oversight of operational performance, risk management, and fiduciary responsibility. Examples might include questionable investments, inadequate responses to regulatory changes, or a lack of transparency in financial reporting leading to shareholder dissatisfaction and potential legal challenges.

Evaluating the competence of a corporate board is crucial for several reasons. Investor confidence, share price stability, and the long-term sustainability of the organization are all directly impacted by the quality of leadership. A poorly performing board can result in significant financial losses, reputational damage, and even regulatory intervention. Historical instances of corporate governance failures highlight the importance of strong, capable boards in preventing such outcomes. Analysis of board composition, decision-making processes, and performance metrics are essential to understanding the validity of such assessments.

Subsequent sections will explore specific instances of alleged shortcomings, examine the impact on stakeholders, and analyze potential pathways to improved governance and accountability within Dominion Energy.

Images References

Source: www.13newsnow.com

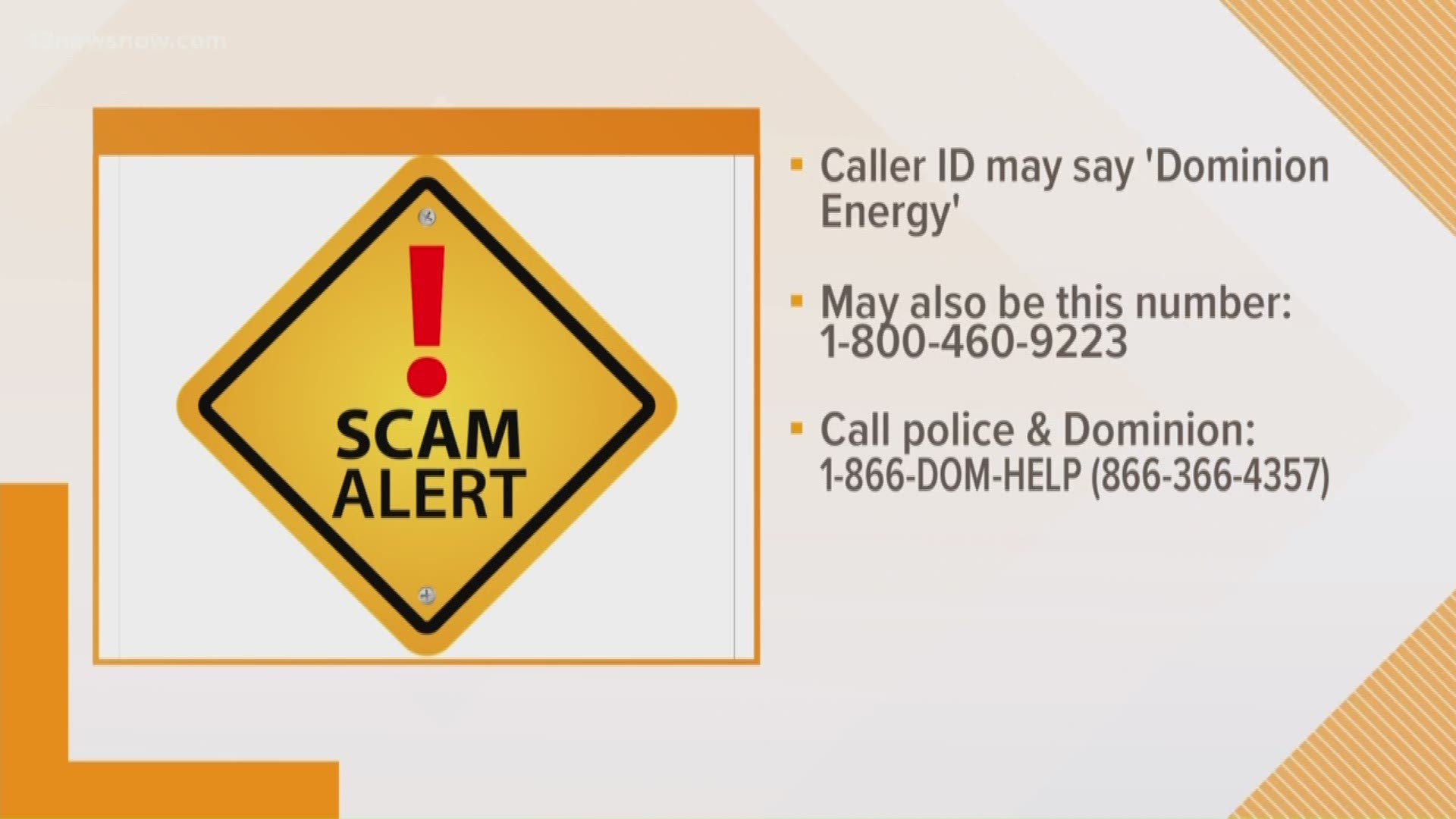

Latest scams targeting Dominion Energy customers

Source: www.standard.net

Consumer alert issued for confusing Dominion Energy letters News

Leave a Reply