The question of optimal operational structure for hedge fund administration often involves comparing different approaches. One such comparison centers on the relative merits of Outsourced Risk and Fund Evaluation (ORFE) solutions versus in-house Compliance (CS) departments. ORFE leverages external specialist firms to handle risk management and performance measurement, while CS relies on internal teams dedicated to regulatory compliance and risk oversight. A critical consideration is the specific needs and resources of the individual hedge fund, as the most effective solution isn’t universally applicable.

The choice between these models significantly impacts operational efficiency, cost structure, and overall regulatory compliance. Utilizing external expertise through ORFE can offer access to advanced technology and specialized skill sets that may be cost-prohibitive to maintain internally. Conversely, an in-house CS function provides greater control and potentially deeper integration with the fund’s internal processes. The optimal approach hinges on factors such as fund size, investment strategy, regulatory environment, and existing infrastructure. Historical trends indicate a growing preference for outsourcing certain functions, but this is influenced by the evolving regulatory landscape and technological advancements.

This analysis will delve into the key considerations influencing the selection between these two administrative models, exploring the advantages and disadvantages of each, and providing a framework for hedge funds to make informed decisions based on their unique circumstances. Specific areas of investigation will include cost-benefit analyses, regulatory compliance implications, and the impact on operational effectiveness and scalability.

Images References

Source: investmentsforexpats.com

Hedge funds iFE Investments for Expats

Source: www.callan.com

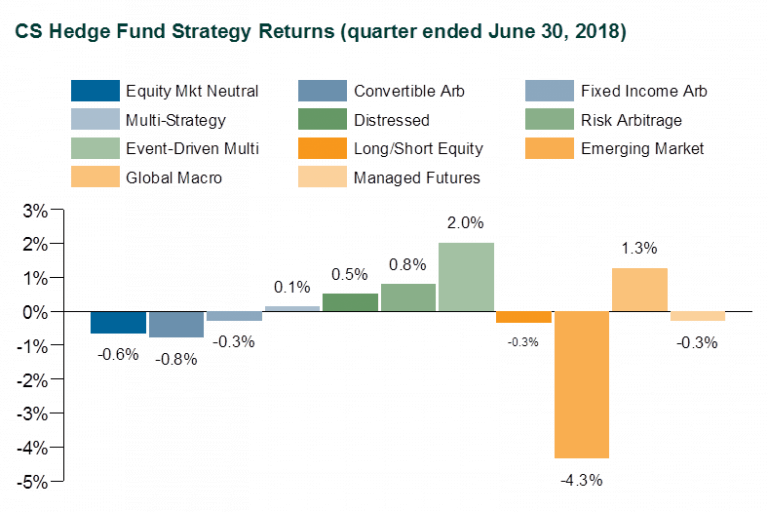

Trade Spat Rains on Hedge Fund Returns in 2nd Quarter

Leave a Reply