Fumigation, a common method of termite control involving a tent-like structure, is a capital expenditure for many businesses and property owners. However, the accounting treatment can vary depending on factors such as the property’s nature (residential versus commercial), the frequency of such treatments, and relevant tax regulations. For example, a large apartment complex might consider recurring fumigation costs as an operating expense, whereas a single-family homeowner would likely classify it as a capital improvement. The cost is generally considered a necessary expense for maintaining the property’s value and avoiding substantial structural damage.

Treating termite infestations is crucial for preserving asset value. Significant structural damage resulting from untreated infestations can lead to far higher repair costs than preventative fumigation. This proactive approach protects investments, minimizes potential business disruptions (for commercial properties), and maintains the safety and habitability of the structure. Historically, less effective termite control methods resulted in more frequent and extensive damage, highlighting the current preventative measures long-term cost-effectiveness.

This discussion naturally leads to a deeper exploration of property maintenance best practices, the complexities of accounting for capital versus operating expenses, and a comparison of various pest control strategies to optimize cost and effectiveness. A detailed analysis of relevant tax codes and regulations is also essential for accurate financial reporting.

Images References

Source: housemanservices.com

What is Termite Tenting? Houseman Services

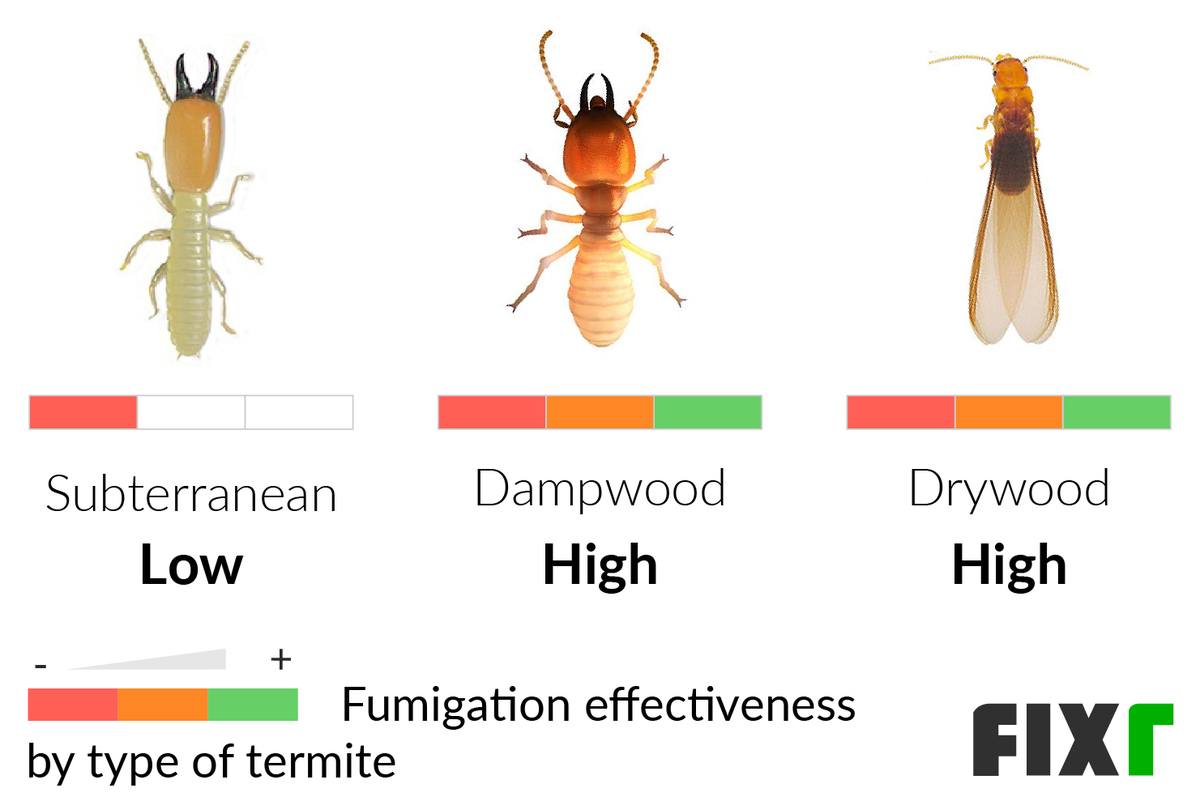

Source: www.fixr.com

2022 Termite Tenting Cost Cost to Fumigate for Termites

Leave a Reply