The question of the financial health and future operations of Zebit, a buy-now-pay-later company, is a matter of significant interest to consumers, investors, and the broader financial sector. This inquiry reflects a broader concern regarding the stability and sustainability of the buy-now-pay-later industry as a whole and the risks associated with this type of consumer lending.

Understanding the factors influencing the company’s performance is crucial for assessing potential risks and opportunities within the short-term lending market. Analyzing financial reports, market trends, and regulatory changes impacting the buy-now-pay-later industry provides valuable insights into the company’s long-term viability and the potential impact on consumers utilizing its services. Historical precedent in similar businesses can also inform predictions about the company’s trajectory. Furthermore, a deep dive into the company’s business model, its customer base, and its competitive landscape aids in forming a comprehensive understanding of its prospects.

Subsequent sections will delve into a detailed examination of Zebit’s financial performance, an analysis of its competitive advantages and disadvantages, and a discussion of the regulatory environment in which it operates, ultimately leading to a more informed assessment of its future.

Images References

Source: www.sitejabber.com

Zebit Reviews 10 Reviews of Sitejabber

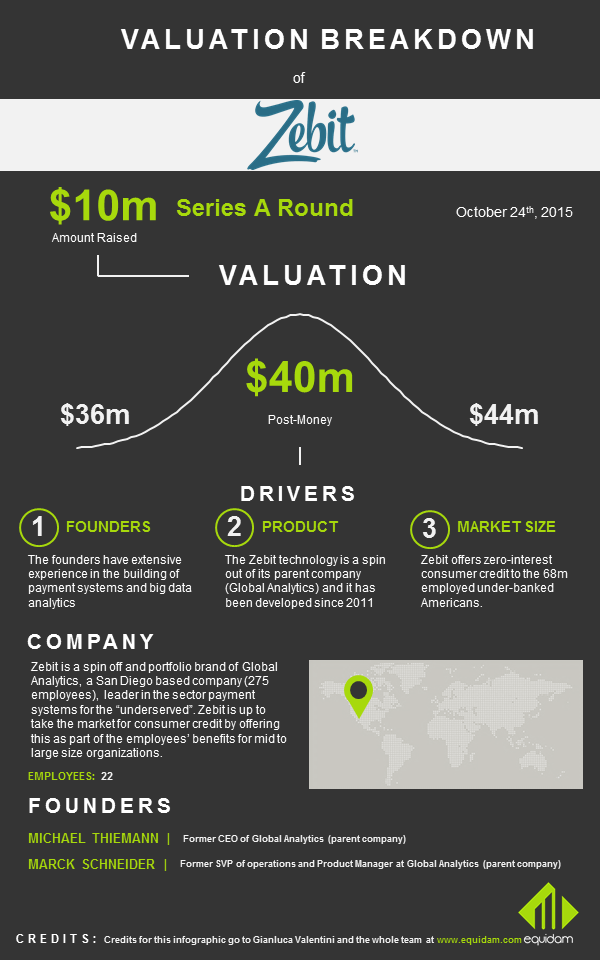

Source: www.equidam.com

Zebit Zerointerest Consumer Credit Startup

Leave a Reply