Selecting a financial institution for efficient credit memo processing involves considering factors beyond simply the bank’s name. A credit memo, a document acknowledging a reduction in a debtor’s balance, requires a reliable and timely processing system. Factors such as online banking capabilities, integration with accounting software, and the speed of funds transfer significantly influence the overall experience. For instance, a bank with robust online portals and quick payment processing will offer a superior experience compared to one with limited digital tools or slow transfer times.

The efficient handling of credit memos is crucial for maintaining accurate financial records and ensuring smooth cash flow management. Prompt processing minimizes discrepancies and reduces the risk of errors in accounting. Furthermore, a streamlined credit memo system contributes to stronger business relationships with suppliers and customers, improving overall financial health and operational efficiency. Historically, manual processing of such documents was significantly slower and more error-prone; therefore, modern banking solutions offering digital integration are highly advantageous.

This analysis will delve into specific features offered by major Canadian banks relevant to credit memo processing. Factors such as online portal functionality, customer service responsiveness, and the availability of integrated accounting solutions will be examined to provide a comparative overview, allowing businesses to make an informed decision based on their individual needs.

Images References

Source: www.savvynewcanadians.com

Personal Finance Savvy New Canadians

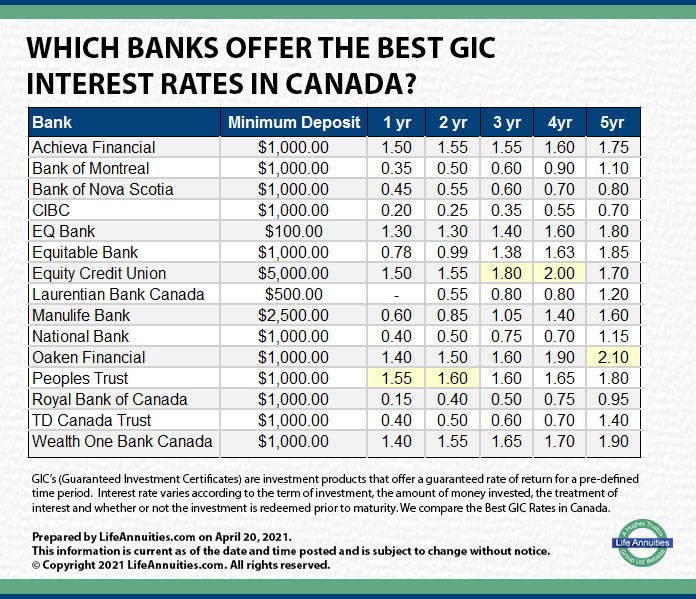

Source: jefferymeowandrews.blogspot.com

Which Bank Is Best for Gic in Canada

Leave a Reply